July Job Numbers Mean Help Needs To Be On Menu

With the release of the July job numbers, it was pretty clear that Canada’s foodservice sector continues to require support to recover its losses and Restaurants Canada is recommending a path forward designed to relaunch the country’s foodservice sector in its pre-budget submission to the federal finance committee

The industry association tabled its pre-budget submission to the federal finance committee, advocating for continued support to help the foodservice industry through the ongoing COVID-19 crisis.

David Lefebvre, Restaurants Canada vice president, federal and Quebec, said that: “Many of the measures that the federal government has introduced over the last few months have provided a lifeline to restaurants during these extraordinarily challenging times. But with colder months approaching, the foodservice sector will need continued assistance to keep fulfilling its critical role within the Canadian economy.”

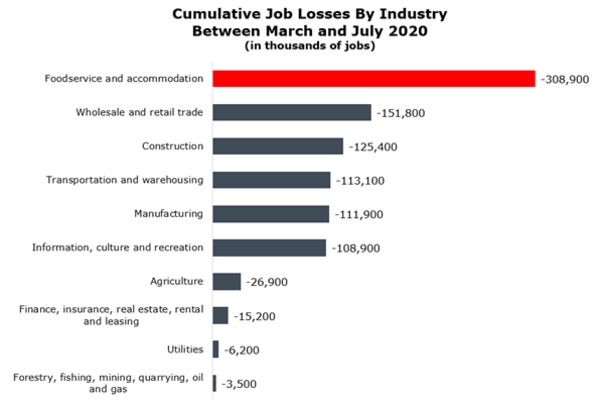

The association notes that while the latest Labour Force Survey from Statistics Canada revealed that foodservice employment rose by 100,500 jobs in July, the sector is still more than 300,000 jobs short of where it was in February.

And it points out that no other industry comes close to continuing to face this level of shortfall.

As a result, Restaurants Canada is calling on the federal government to extend and strengthen support for foodservice businesses in the following areas so they can continue contributing to Canada’s recovery in 2021.

Assistance with labour costs, rising debt and cash flow

The following programs should continue to be available in 2021 to support foodservice businesses still struggling to operate under ongoing restrictions:

- The Canada Emergency Wage Subsidy (CEWS)

- The Canada Emergency Business Account (CEBA)

These COVID-19 response measures have made a meaningful difference in the short term and should be extended and strengthened to support business continuity over the longer term.

Restaurants Canada also recommends changes to the tax regime to further support businesses struggling with cash flow. Simplified rent relief provided directly to businesses is also needed.

Red tape reduction for small and medium-sized businesses

Restaurants Canada is recommending that any new legislation and measures that were put on hold due to the COVID-19 pandemic be reassessed to consider the new economic realities for businesses.

Hurdles to doing business should be limited wherever possible while small and medium-sized enterprises continue to struggle to remain operational under ongoing restrictions.

Targeted foodservice sector support

Sector-specific measures are needed to address some of the unique challenges that restaurants and other foodservice businesses have endured due to COVID-19. Restaurants Canada has provided a number of recommendations based on input from its members.

All recommendations contained in the full submission from Restaurants Canada can be consulted here: info.restaurantscanada.org/hubfs/2021%20Federal%20pre-budget%20submission_Restaurants%20Canada.pdf

The association also makes it clear that a thriving foodservice sector is critical to Canada’s recovery from COVID-19:

- Restaurants and other foodservice businesses are the fourth-largest source of private sector jobs and number 1 source of first jobs for Canadians, typically employing 1.2 million people.

- Restaurants support a wide variety of supply chain businesses, indirectly supporting more than 290,000 jobs.

- Restaurants typically spend more than $30 billion per year on food and beverage purchases, playing a critical role for Canadian farmers and the agri-food sector.

Go to www.restaurantscanada.org for more.

Tags: