Absolutely Spectacular

There have been deals and there have been deals, but it is hard to find a comparison to the announcement that Air Canada and Transat A.T. Inc. have successfully concluded a definitive Arrangement Agreement that will see Air Canada acquire all issued and outstanding shares of Transat, resulting in its combination with Air Canada.

It is absolutely spectacular.

Under the terms of the binding agreement, unanimously approved by the Board of Directors of Transat, Air Canada will acquire all outstanding shares of Transat for $13 per share. The value of the all-cash transaction is approximately $520 million.

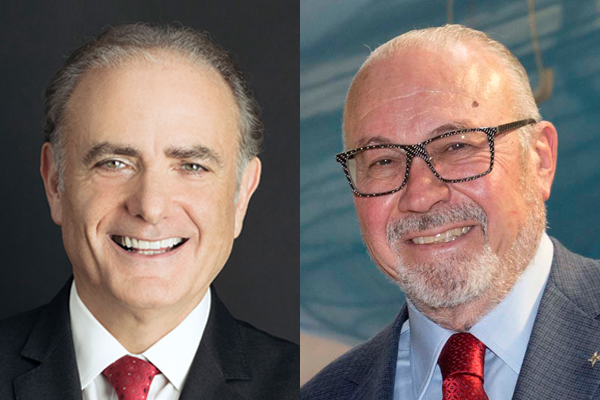

Calin Rovinescu, president and chief executive officer at Air Canada, said: “We are delighted to have reached this definitive agreement to combine Transat with Air Canada to achieve the best possible outcome for all stakeholders.”

Rovinescu said that: “For shareholders of Transat and Air Canada, this combination delivers excellent value, while also providing increased job security for both companies’ employees through greater growth prospects.”

Air Canada’s president and CEO continued: “Air Canada intends to preserve the Transat and Air Transat brands and maintain the Transat head office and its key functions in Montreal. Both companies have demonstrated excellence as evidenced by the 2019 Skytrax Awards. Travellers will benefit from the merged companies’ enhanced capabilities in the highly competitive, global leisure travel market and from access to new destinations, more connecting traffic and increased frequencies.”

And Rovinescu added: “The Quebec economy will derive maximum advantage of having a Montreal-based, growth-oriented global champion in aviation, the world’s most international business.”

Jean-Marc Eustache, president and chief executive officer of Transat, said of the agreement: “We are very pleased to join forces with such a successful player in our industry. The combination with Air Canada will give Transat new perspectives of growth, with the support of a strong network offering many options for connecting traffic.”

Eustache continued: “This fully-funded cash transaction is the ideal platform for Transat’s presence and jobs in Montreal, and therefore represents the best option for all our stakeholders: employees, suppliers, partners and shareholders.”

And he continued: “For our clients, it will offer even more choices and possibilities. For now, they can continue booking their flights and packages with complete confidence, as all bookings will be honoured before and after the closing of the transaction.”

The transaction remains subject to regulatory and shareholder approvals and other closing conditions usual in this type of transaction. If such approvals are obtained and conditions are met, the transaction is expected to be completed in early 2020.

Key points of the deal include:

- Transat’s Board of Directors has unanimously approved arrangement and recommends shareholder approval

- Combination of Skytrax Best Airline in North America and Skytrax Best Leisure Airline in the world to create Montreal-based global leader in leisure, tourism and travel distribution, offering Canadians choices to more destinations and promoting two-way tourism.

- Air Transat and Transat brands to be maintained to complement the Air Canada, Air Canada Rouge and Air Canada Vacations brands.

- Transat head office and key functions to be preserved in Montreal; made-in-Quebec combination to provide compelling platform for future growth and employment.

- Purchase of outstanding Transat shares at $13 per share subject to regulatory and shareholder approvals. Purchase price represents premium of 156% over 30-day volume weighted average price (VWAP) of Transat shares and 143% over 90-day VWAP11 prior to Transat’s announcement of a potential sale process on April 30.