Are We Ready For Takeoff?

In its newly released “Recovery Insights: Ready For Takeoff?, Mastercard takes a look at some of the key trends in air and ground travel around the world.

Developed by the Mastercard Economics Institute, the report draws on aggregated and anonymized sales activity across the global Mastercard network to better understand the next phase for travel, its drivers and challenges.

This includes the balance between leisure and business, local and long distance, and saving and spending; and it also looks at the spending categories seeing an uptick and what they signal for travel recovery.

While the global travel recovery remains uneven, one-fifth of countries studied have returned to at least 90% of pre-pandemic levels for domestic flight bookings.

Bricklin Dwyer, Mastercard chief economist and head of the Mastercard Economics Institute, points out that: “While there’s been an impressive recovery in domestic air travel in a number of markets, the rebound won’t happen overnight. The pandemic brought the industry down to spending levels not seen in over 15 years.”

Dwyer continued: “While a lot of uncertainty remains, pent-up savings, a desire to venture farther from home, and the green light from governments could all provide significant tailwinds for the continued travel recovery.”

Key trends revealed in the report include:

- Global gasoline spending is up 13%* from its previous peak in 2019. Road trips — the big trend of 2020 — aren’t going anywhere. The report shows robust demand for local travel and lesser-known locales, such as Devon and Cornwall in the UK. In the US, more people are also traveling across the country by car, with 25% of vehicle rentals used for interstate travel.

- As people prepare to reemerge, pent-up savings help fuel sales across a variety of categories. For instance, sales at toupee and wigs stores have increased 75% in the past year compared to pre-pandemic, and sales for beauty salons and luggage stores are also up. Meanwhile, spending at boat dealers (+30%) and bike stores (+62%) also grew, as pent-up demand collided with greater savings due to fiscal stimulus and savings from mobility restrictions. The US, followed by Canada, Belgium, and Australia, had the most “excess” savings as a percent of annual personal consumption expenditure.

- Air travel remains down significantly globally, with some positive pockets. According to the analysis, one-fifth of countries studied have returned to at least 90% of pre-pandemic levels for domestic flight activity. While some — including the US, Australia and France — are exceeding pre-pandemic domestic flight bookings, others — such as Canada, Thailand and New Zealand — are at a fraction of where they were before the pandemic began.

- Global business travel lags global leisure travel by approximately four months. Global business travel is showing recovery signs, with Australia domestic corporate travel bookings at nearly 80% of pre-COVID levels. Additionally, US domestic corporate travel is back up to just over half of its average level from 2019.

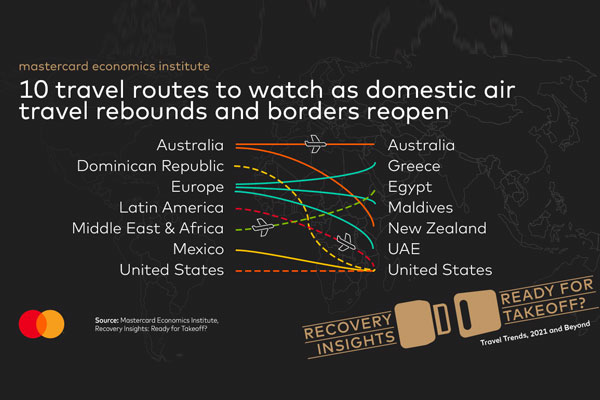

- Border reopenings have fuelled 10 interesting travel corridors. The limited border reopenings have proven to be challenging for travellers and the travel industry alike. But the select open corridors such as between Australia and New Zealand and between the US and Latin America and the Caribbean are meeting and, in some cases, exceeding pre-pandemic levels.

- Raj Seshadri, president of data and services, Mastercard, observed that: “The past year has only reinforced how important travel is — to our connection with friends, family and the broader world, to our business communities, and to our personal fulfillment.”

Seshadri continued: “The economic implications of tourism are vast, with virtually no industry untouched when travellers stay home. Through Recovery Insights, we’ve helped airlines redesign travel routes, retailers rejig inventory, and cities understand shifts in neighbourhood spending. It’s about enabling smarter decisions for better outcomes — today and tomorrow.”

Mastercard launched Recovery Insights to help businesses and governments better manage the economic risks presented by COVID-19. Through this initiative, Mastercard has provided data-driven insights, analytics and other services to businesses and governments to help them understand ever-changing consumer spending trends and how to address them.

To access the full report, click here.