Back To The Beginning

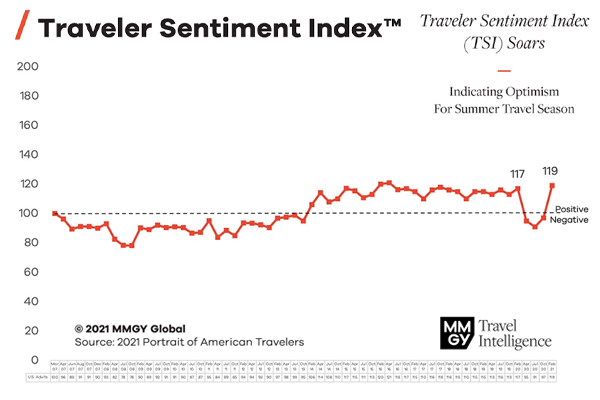

Following a year of uncertainty — along with constantly changing attitudes and policies toward travel – there is now unprecedented optimism from leisure travellers in advance of the summer travel season.

That’s the good news in the 2021 spring edition of MMGY Travel Intelligence’s

In it, the Traveler Sentiment Index (TSI) rose to 119 (pre-pandemic levels), affirming that U.S. adults are thinking much more positively about travel than they were throughout this past year.

Yet while there is much optimism, concerns for safety continue to affect demand, although not slowing what is a considerable increase in travel intent. Along with positive signs such as increased vaccinations and decreasing COVID-19 cases and hospitalizations, safety remains below its pre-pandemic levels. At the time of the survey, it lingered 12 points lower on the TSI than it did in February 2020.

Chris Davidson, EVP, MMGY Travel Intelligence, observed: “It has been a devastating year for the travel industry, but companies have remained incredibly resilient and steadfast in their commitment to meeting travellers’ needs and concerns.”

Davidson said that: “The results from the study show that we are already in the midst of an impressive rebound, and travel companies should leverage these insights and use them to guide their strategies in the months ahead.”

MMGY Travel Intelligence found that the top states of interest among U.S. travellers over the next two years are Hawaii (64%), Florida (62%), California (53%), Colorado (50%), Alaska (49%) and New York (49%).

It is also important to note that some destinations – Portland, Seattle and Washington, D.C. – have experienced large decreases in interest, which is likely the result of extensive political and social unrest that occurred in these destinations throughout the past year.

There is some interest in international destinations. However, it remains relatively low with only 19% of leisure travellers indicating that they are likely to take an international trip in the next six months – down from 24% in January 2020.

Road trips continue to be the most likely form of near-term vacation travel. Three in 5 U.S. adults (62%) expect to take at least one leisure vacation during the next six months with the preferred mode of transportation being personal car, while 2 in 5 (38%) say they will take a domestic flight.

Looking further out to the next 12 months, 4 in 5 (81%) U.S. adults expect to take at least one trip.

The intent to take a vacation during the next six months decreases with age and increases with household income.

Active leisure travellers – those who intend to travel within the next 12 months – expect to take 3.7 overnight leisure trips this year and spend an average of $2,415 on those trips.

Gen Xers and Boomers intend to take fewer trips than Gen Zs and Millennials, but these seasoned travellers intend to spend more overall.

This difference in spending expectations is likely because Boomers tend to have more available time for travel, more discretionary income, and they’re the generation that’s first in line for COVID-19 vaccinations.

Though travellers are ready to spend on vacations, they are also anticipating travel deals.

Perceptions around the affordability of travel have far surpassed pre-pandemic levels (up 29 points), and this metric was the only TSI component that did not take a significant dip throughout the pandemic as travellers expected travel companies to slash prices given reduced demand.

Corporate business travel demand has historically driven fare and rate strength. However, MMGY Global’s CEO, Clayton Reid, foresees a unique and historic shift in this dynamic ahead.

Said Reid: “MMGY Global believes the next six months will see a unique environment whereby weekend leisure travel demand is so significant that it pushes leisure demand to weekdays, thereby displacing traditional corporate travel.”

Reid explained: “We are calling this ‘reverse compression.’ We think trip volume will not only be led by leisure demand but that fare and rate strength will also come first from consumers and second from business, even in market environments and periods where that just doesn’t happen.”

The pandemic has had a profound impact on travel behaviours.

Travellers are doing more driving than flying, showing preference to outdoor destinations rather than cities and, perhaps unexpectedly, expressing an increasing focus on the impact of their travel.

Fifteen percent of active leisure travellers indicate a travel service provider’s focus on sustainability and environmental considerations greatly impacts their travel decision-making.

This sentiment is more evident among younger travellers who showed greater willingness to pay more for travel brands that demonstrate environmental responsibility than their older counterparts.

Though the intent to spend more with travel companies that demonstrate environmental responsibility declines the older the traveller segment, 83% of active leisure travellers overall indicate they are open to changing some aspect of their travel behavior to reduce their impact on the environment.

For example, visiting destinations in the off-season to reduce overcrowding and using less single-use plastics while traveling appear to be changes most are willing to make.

Go to www.mmgyintel.com/products/traveler-profiles for more.