I wish I had a crystal ball

A conversation with Dave Hilfman, Interim Executive Director, Global Business Travel Association (GBTA)

In the second part of canadian travel press’ conversation with GBTA’s interim executive director, Dave Hilfman, the discussion turns to the future

and how the industry and the association is preparing for what’s to come.

So, is business travel dead in the water for the foreseeable future? Does GBTA have any intelligence/data that shines a light (even a little) on where business travel might be heading? Is the worst over or is there still more to come?

Hilfman

I wish I had a crystal ball to help out in the forecasting of future business travel. The truth is – we just don’t know for sure yet. What we do know is that business travel is critical to the world’s economy and we’re hopeful to see it restart as quickly as it’s safe to do so.

We poll our GBTA members regularly to measure the impact of COVID-19 on their organisation and here’s the latest results:

GBTA Poll: We see the continued halt of business travel across the globe. While two in five (44%) report they expect domestic travel to resume (in some capacity) in the next 2-3 months, one in five (16%) expect international travel to resume in the same time period.

GBTA Poll: GBTA members in Europe (77%) are more likely than members in North America (37%) to expect domestic business travel to return in the next

2-3 months.

GBTA Poll: 83% of GBTA member companies report they have canceled or suspended all or most business travel to/within the US.

GBTA Poll: a majority of GBTA member companies (86%) report they have suspended or canceled all business travel regardless of location.

Does GBTA have any intelligence/data on when companies expect to have their people travelling again?

Does GBTA have any intelligence/data on when companies expect to have their people travelling again?

These are the Global results:

Does that intelligence/data indicate specific factors – changes in government travel restrictions, to border closures, development of effective treatments or a vaccine – that would speed up the decision by companies to get their people back on the road?

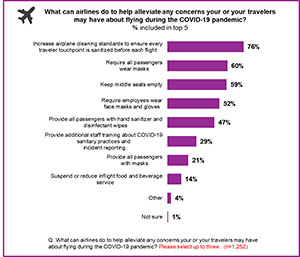

Consistent health and safety protocols across each of the travel verticals. Health and safety are by far the most important priorities in our current environment. When passengers are deciding which airline to take, sanitation is more important than anything else – more important than flight times, price, convenience, loyalty status, or food.

Obviously border closures, free movement of traffic is also required.

I’m also wondering what kind of intelligence the GBTA has from other parts of the world in terms of whether business travel is beginning to start up again? I’m thinking of Europe which, right now, seems to be in a good place as far as managing the virus goes.

Domestic and essential business travel is likely to resume first. Among respondents who report their company has canceled at least some domestic business trips, four in ten (44%) expect domestic travel to resume in the next 2-3 months. One in three expect domestic travel to resume in the next 6-8 months (34%) or are unsure (15%). GBTA members in Europe (77%) are more likely than members in North America (37%) to expect domestic business travel to return in the next 2-3 months.

Among GBTA companies who have canceled at least some international business trips, one in ten (16%) expect international travel to resume in the next 2-3 months. Two in five expect international travel to resume in the next 6-8 months (40%) and one in four are unsure (25%) as to when international travel will resume. GBTA companies based in Europe (33%) are more likely to expect international business travel to resume in the next 2-3 months than are members based in North America (13%).

The return to travel from a supplier perspective follows a similar geographical divide, with more travel suppliers and travel management companies (TMCs) in Europe reporting an increase in bookings (50%) than in the US (27%).

The slow recovery of business travel continues with a noticeable uplift in Europe. The US recovery has remained largely static, probably in line with new COVID-19 cases that dominate our headlines, slowing progress.

What about Canada? What is the GBTA’s read on Canadian business travel market? What kind of feedback are you getting from your members here?

Bookings are slowly on the rise in Canada and there are definite green shoots of recovery. Although 76% of respondents cancelled or suspended all or most travel, we are encouraged that 40% of respondents are looking to resume domestic travel in the next 1-3 months. International travel will take longer.

Bookings are slowly on the rise in Canada and there are definite green shoots of recovery. Although 76% of respondents cancelled or suspended all or most travel, we are encouraged that 40% of respondents are looking to resume domestic travel in the next 1-3 months. International travel will take longer.

Travel managers are engaging with suppliers and 63% have revised their travel policy following the pandemic.

Last question: Is there something that I haven’t asked that you think needs to be asked? And, if you do, what is it and what’s the answer?

I think you asked all the right questions. Everyone is anxious to get the corporate travel industry back on its feet and people working again who have been impacted through the pandemic.

I think you asked all the right questions. Everyone is anxious to get the corporate travel industry back on its feet and people working again who have been impacted through the pandemic.

From a personal perspective, I’m very proud to have been asked to serve GBTA as interim executive director during this extraordinary time in our history. I have a deep love for the travel industry and its people and want to do all I can to assist in the recovery efforts as we look toward the future.

It’s also a perfect time to hit the “reset” button for our organization as we find ways to do things better in this new business environment. I’m confident we’re going to come out of this stronger than ever.