Tracking the shift

Mastercard report finds consumer demands are evolving

BOB MOWAT

Dwyer

Despite the travel industry’s challenges, Bricklin Dwyer, chief economist for Mastercard, tells Canadian Travel Press, there are a few trends that have emerged that mirror broader consumer spending – in particular the shift to a smaller radius as consumers travel and spend closer to home. And Dwyer adds that “right now, our focus should be on how travel behaviours are pivoting, what consumer demands are evolving and how we can support the needs of all players in travel to map out a new future for the industry.”

Can you provide a brief overview of the kind of impact that COVID-19

has had on travel and entertainment spending? Are there positive results to note from the report?

It’s no secret the travel industry was hit hard from COVID-19, especially air travel; however, despite the many challenges brought on by the pandemic, there are promising signs in consumer spending on travel.

Overall, we are seeing some improvement month over month compared to 2019 levels and while we know progress is neither even nor linear, our latest report in the Recovery Insights series details the growing demand in travel spending.

To give our readers some insight to Mastercard’s Recovery Insight Report series, would you be able to provide more details on some of the findings in the first report?

The Shift to Digital, our first Recovery insights report in June, identified key retail trends to watch. (https://www.mastercardservices.com/en/recovery-

insights/shift-digital)

In response to mobility restrictions put in place in many areas, businesses in many regions across Canada were quick to bolster their digital presence in order to maintain some level of sales. Virtually, every sector has seen a greater shift into digital channels as many people adapted to a new reality by looking online to acquire goods and services.

The report revealed that e-commerce sales in Canada more than doubled (123.2%) for the month of May, compared to the same month the year prior. During this same period, total Canadian retail sales grew by 5.8% compared to the same month the year prior, which indicated that consumer spending appeared to be on the rise and normalizing.

With Mastercard’s second report measuring the impact upon both air/land, domestic and international travel spending in the G20 countries, would you be able to highlight some of the findings in each of those sectors? Are there any trends showing improvement in the travel industry?

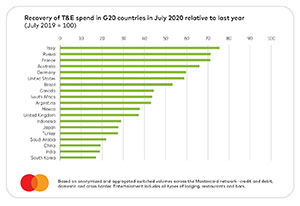

Overall, Europe is leading the way, with Italy in the top spot for travel-related spending. In addition to identifying emerging trends in retail spending, the research evaluated air, land, domestic and international spending to see where, how and why people are travelling from both levels.

From a global air travel perspective, we found airline spend across Europe, North America, the Middle East, Africa and Asia Pacific was less than a tenth of 2019 levels by mid-April. However, since Europe announced it was opening its gates, spending on air travel has recovered faster than the other regions.

From a global air travel perspective, we found airline spend across Europe, North America, the Middle East, Africa and Asia Pacific was less than a tenth of 2019 levels by mid-April. However, since Europe announced it was opening its gates, spending on air travel has recovered faster than the other regions.

China and Russia are also the top two G20 nations who are experiencing quick airline spend recovery, followed by France, Italy and Turkey.

While recent lifts in travel restrictions are pointing us in a positive direction, it doesn’t necessarily mean people are ready to buckle up just yet.

On the other hand, the number of travellers crossing European borders on the ground tells a more hopeful story for land travel.

In Europe, cross-border gasoline sales are now surging relative to the rest of the world, which could be influenced by the current ease of driving across borders relative to flying.

Many countries all over the world are seeing some uptick in domestic gasoline sales, with Canadians being one of the highest purchasers of gas during COVID-19 compared to the other G20 countries.

To view Mastercard’s second Recovery Insights report, Travel Check-In, go to https://www.mastercardservices.com/en/recovery-insights/travel-check-in?source=display&cmp=global.en-us.global.b2b.mastercard.com.mc.report..trv.ri-travel-check-in..download.press-release.hub.

NEXT ISSUE: Mastercard’s Bricklin Dwyer talks about new trends developing as a result of COVID-19’s impact on the travel industry — what they are and how they might change the way that the industry deals with its customers.