Millennials Being Priced Out of Skiing, Golf Holidays

It’s a concern that sports tourism officials may want to examine closely… while millennials desire active holidays more than any other generation, financial limitations mean that fewer of millennials are participating in particular types of sporting holidays, such as golf and skiing.

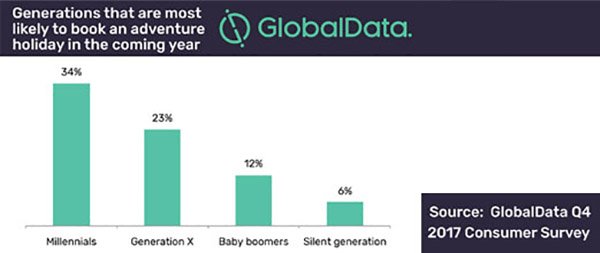

This, according to GlobalData, a leading data and analytics company, whose latest report, “Exploring Sports Tourism,” indicates that millennials are most likely to go on an adventure or sport holiday, with millennial participation still being high for a number of sporting holidays, such as surfing. However, some sporting holidays are very expensive and have been seen to “price out” younger people. A consequence of this is falling participation among this generation for these forms of activity holidays, with skiing and golf seeing a particular decline among millennials.

Skiing is one of the most popular sporting holidays and in many ski resorts, baby boomers are the most common age group; more than two-thirds of skiers from the UK are aged between 43 and 65. However, the size of the boomer generation is shrinking and younger generations – notably millennials – are less engaged in the sport and are going on fewer ski holidays than previous generations.

When Generation X was aged 17-32 they comprised 40% of annual snow sports visits, in comparison, millennials currently make up around 32%, according to the NSAA National Demographic Study. The reason for this is largely because of the expense involved with skiing. Millennials face bigger financial challenges than their boomer parents and few can justify the cost of going on a ski holiday.

Sean Hyett, Travel & Tourism Analyst at GlobalData, commented, “Tourism boards and ski resorts should attempt to get more young people engaged in skiing by offering discounts on the costs involved with the sport. For example, they could start offering a discounted ‘millennial’ pass.”

In the US, over three-quarters (78%) of golfers are male, with an average household income of US$95,000 and average age of 54. This reflects that the sport is popular among older people with high incomes. However, the golf industry has witnessed an overall decline in participation, so expanding the target market is essential to see long-term growth.

Hyett continues, “Younger generations are put off by factors such as the cost, the amount of time it takes to play a round and the negative perceptions of golf. Holiday providers can include activities outside of golf in the package and advertise local nightlife. Additionally, holiday providers could use social media to advertise their holidays which will better reach a younger and more diverse audience. Millennial uptake needs to exceed boomer exit for the skiing and golf industries to grow and survive in the long term. Therefore, adopting methods to get more young people going on these holidays will be essential.”