NTA identifies pathways to success in new survey

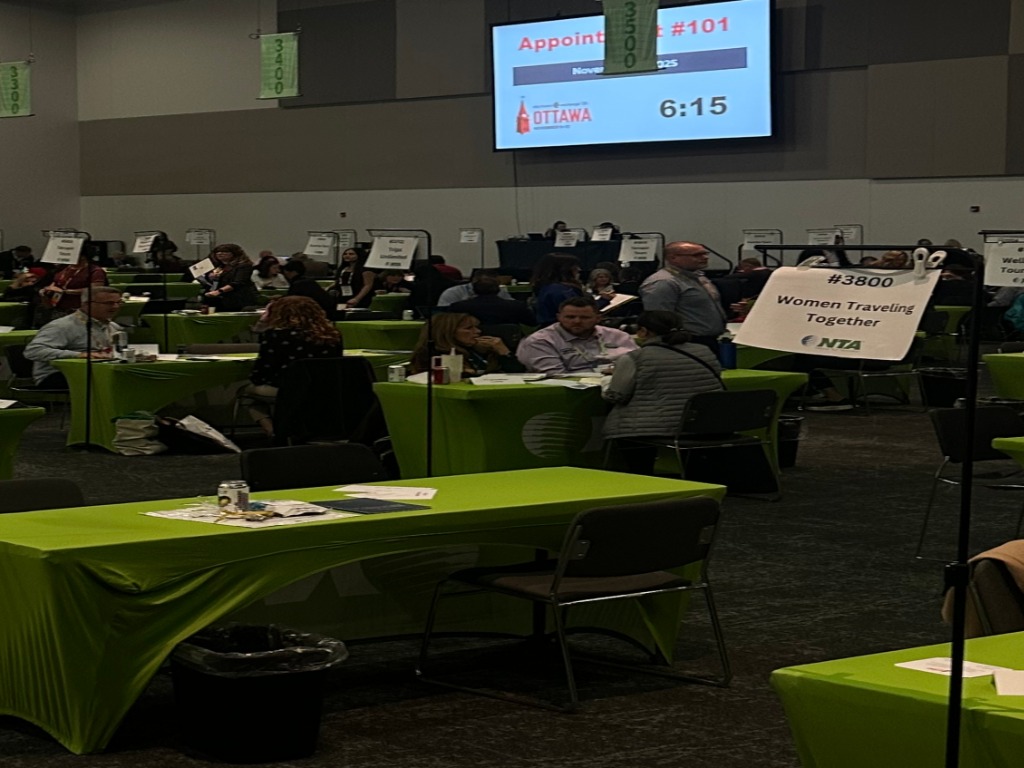

As more than 600 tour operators, DMOs and tour suppliers (from 48 states and 9 provinces) gathered in Ottawa for its annual business marketplace and conference for the packaged travel industry this week (Nov. 9 to Nov. 12), the National Tour Association (NTA) released a new survey that tapped into members’ business results in 2025 and their projections for 2026.

NTA President Catherine Prather, CTP, observed that: “The NTA community excels at collaborating,” and continued: “I’m eager for NTA to use the results of this survey to help members assess challenges, find solutions, and become even better partners for each other.”

The majority of NTA members report that business and visitation in 2025 is up from 2024. Similarly, the majority is projecting year-over-year growth for 2026, with DMOs attributing the improved business to major events such as America 250, Route 66 Centennial, and FIFA World Cup; expanded marketing and sales efforts; new or upgraded tour product; and anticipated international market recovery.

Conducted between Oct. 13 and Oct. 29 – just before the NTA’s Travel Exchange (TREX) event – Prather said of the survey results: “It’s encouraging to see that a majority of NTA members have had a successful 2025 in what has been a challenging year, and even better: Most anticipate increased business in 2026.”

Naturally, one of the questions that NTA asked members was about the “most significant” challenges they saw for their company going into 2026.

Three-fourths (76%) of responding operators cited rising vendor costs (lodging, dining, transportation, attractions, etc.) as their biggest challenge. More than a third (37%) pointed to declining consumer confidence or discretionary spending. Nearly three in ten (29%) mentioned supplier availability or scheduling constraints, while a similar share (27%) cited increased competition from online or do-it-yourself trip planning.

About one in five (21%) identified staffing shortages and workforce turnover, and an equal percentage noted regulatory or policy changes — such as visa issues, national park fees, and sustainability or overtourism policies — as key challenges.

Tapping into group travel trends, tour operators were asked about new opportunities or trends they saw shaping multi-day packaged travel in the next three to five years.

Smaller and more flexible groups were mentioned most frequently; followed by authentic, immersive, and experiential travel; sustainable, responsible, and regenerative tourism was mentioned next; visiting lesser-known destinations; slow travel was also cited; and so were shorter tours and hub-and-spoke models.

Operators provided insights into the types of travel (tour themes) that they’re putting more time and money into because they see a growing demand.

Topping the list, by a significant margin (55%) were ‘heritage and history’ tours.

For other types of travel were cited by similar percentages (29% to 31%) and included food and drink; events and festivals; cruises (either river or ocean); and active and adventure.

And when asked which markets (types of travellers) they’re putting more time and money into, 49% of operators said Luxury. After luxury, operators cited family/multi-generation groups, followed by faith travellers, women-only tours, and solo travellers.

The NTA survey also asked tour operators which changes in traveller expectations had most influenced their product planning for 2026 and found that the desire for more personalized and flexible itineraries was cited by 53% of respondents.

Forty-one percent indicated it was interest in small-group or private departures, while others pointed to interest in immersive of educational experiences, high-comfort experiences, shorter itineraries and value-driven options.

With the recent changes in U.S. government policies and actions, NTA asked U.S. based tour operators if there is a year-over-year change for 2026 bookings to Canadian destinations.

Of those who package Canada, 54% said bookings are stable, 34% are seeing a decline in bookings for Canada, and 10% are seeing an increase. Asked about 2026 bookings to overseas destinations, almost half (49%) the operators who package overseas report an increase (with 21% of them saying it’s a significant increase), 38% report bookings are stable, and 13% are seeing a decrease.

When asked about visitation from both Canada and overseas markets in 2025, most U.S. based tour suppliers said reduced Canadian visits negatively impacted their guest numbers: 40% say the impact is minor (causing less than a 10% decline in overall visitation), and one-third (33%) say the drop in Canadian visitors has had a larger impact (dropping overall numbers 11% or more), with 13% saying reduced Canadian visitation dropped their overall numbers by more than 25%. Nearly a quarter of respondents (23%) report no impact.

As for reduced travel from overseas markets, 42% of tour suppliers say they saw no impact in 2025, 32% report a minor impact, and 26% say the impact was more significant, causing an overall decline in guests of more than 10%. Asked when they expect inbound travel from Canada and overseas markets to recover to pre-2025 levels, 40% anticipate a recovery in 2026, and another 40% predict it will be 2027. 14% say they are unaffected by those markets.

Most U.S.-based DMOs said reduced Canadian visits negatively impacted their visitation numbers: 37% say the impact is minor (causing less than a 10% decline in overall visitation), but nearly half (47%) say the drop in Canadian visitors has had a larger impact (dropping overall visitation 11% or more), with 16% saying reduced Canadian visitation dropped their overall numbers by more than 25%. DMOs reported a lesser impact from reduced overseas visitors, with 59% saying it had a minor impact, and 18% terming it a moderate impact (11–25% decline in overall numbers) and 22% reporting no impact. Asked when they expect inbound travel from Canada and overseas markets to recover to pre-2025 levels, more than three-fourths (77%) predict it will be 2027 or later, and 23% anticipate a recovery in 2026.

Go to www.NTAonline.com or www.NTAtravelexchange.com for more.

In the photo

TOP

Destination Northern Ontario’s Mike Wozney and Ian McMillan