US Short Term Rentals Struggle To Keep Up

According to half-year analysis by short term rental (STR) data specialist Key Data, the US short term rental market has struggled to keep up with the rest of the world in 2023.

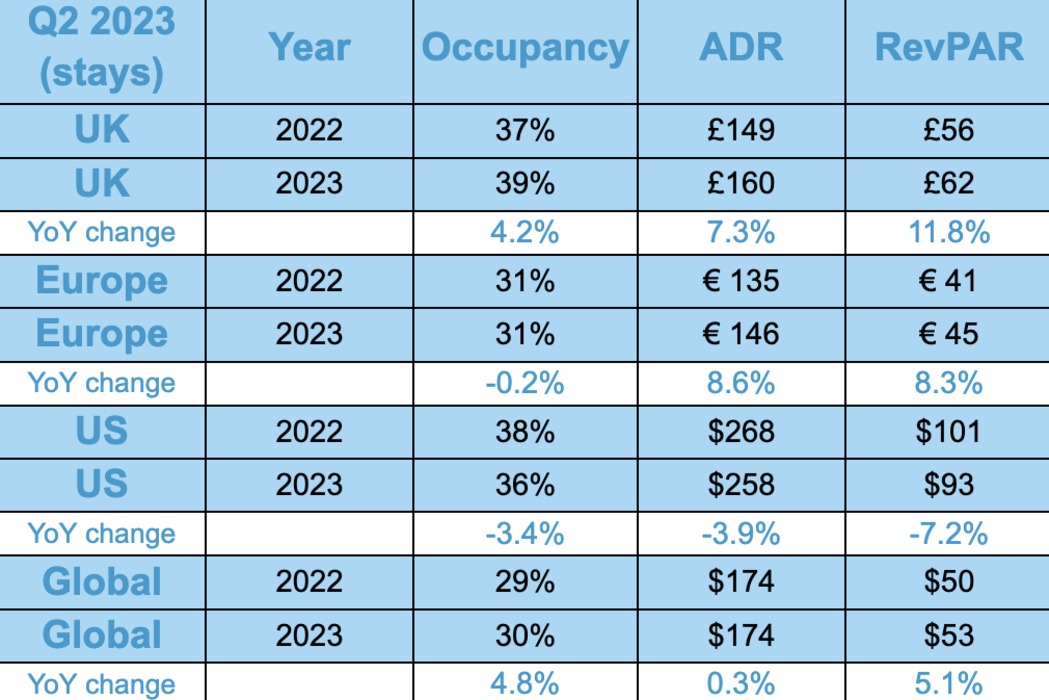

It notes that although Revenue per Available Rental (RevPAR) increased in Europe, in the UK, and globally during the first six months of the year, it fell sharply in the US, where occupancy hasn’t been making up for softer Average Daily Rates (ADRs).

Key Data reports that Global RevPAR rose 5.7% to $49 for stays taken between January and June, largely due to an increase in occupancy which offset a modest 2.8% annual rise in ADR to $173. This represents a significant fall in ADR because these figures are not adjusted for inflation, which reached 7.4% in the 38 OECD countries in April, according to latest figures1.

When this is contrasted with the US, it’s clear the American market is suffering from a slowdown created by the combination of a cost-of-living crisis and a much larger stock of available rentals than existed a few years ago.

US RevPAR fell 3.3% to $89 in the first half of the year, ADR was down 2.3% to $260, while occupancy was down a single percentage point at 34%. Inflation reached 4% in the US in May (YoY) and the average booking window fell (ABW) from 45.1 days to 41.2 days.

In comparison, the UK and Europe saw very robust ADR figures.

The UK saw RevPAR jump by 9.2% to £53 in H1, potentially taking it close to real-term growth after latest figures suggested that CPI in the UK reached 8.7% in May. Occupancy was down 0.9% at 34% but this was offset by a 10.1% rise in ADR to £155.

In Europe, RevPAR was up 5.4% at €36, while occupancy was down 4.8% at 26% and ADRs were up 10.7% at €141. Euro area CPI was 5.5% in June, meaning nightly rates have climbed well ahead of inflation.

Looking ahead, if recent performance is anything to go by, these major markets still appear to be on markedly different trajectories. In Q2, RevPAR both in the US and globally weakened, while in Europe and the UK it strengthened, helped again by stronger occupancy and nightly rates.

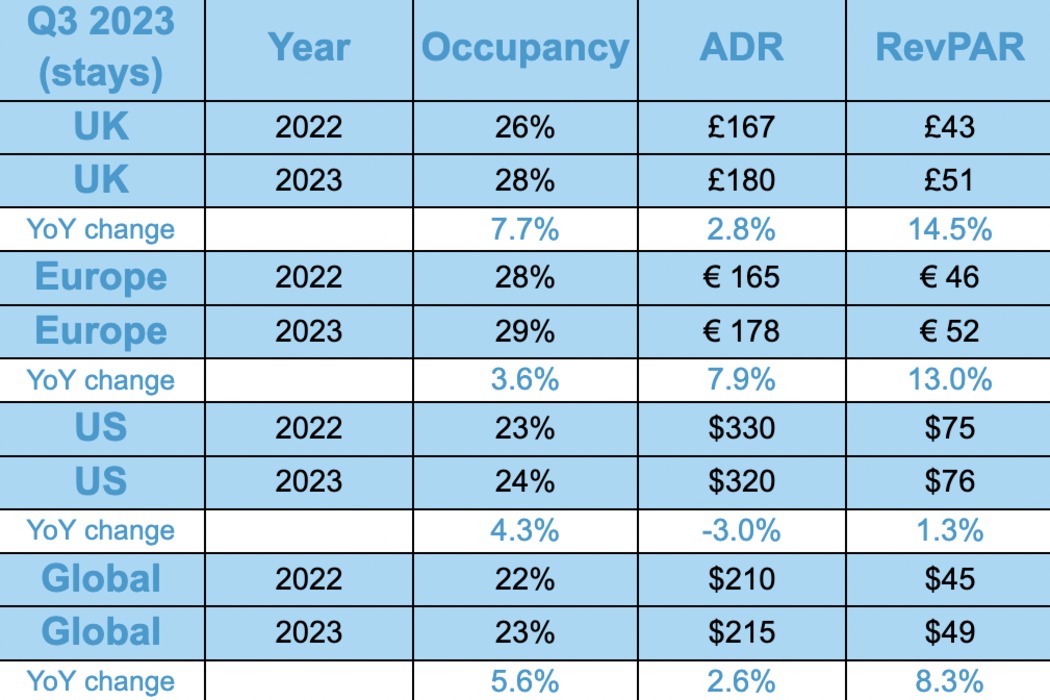

Looking at ‘on the books’ (OTB) data for Q3 globally, the outlook is far more positive than the previous quarter. Q3 stays are showing an 8.3% year-on-year increase in RevPAR, which probably means the market is back to real-terms growth. Growth in occupancy globally has nearly doubled to 5.6% annually for stays in Q3 so far.

In the US, the market is strengthening. RevPAR is seeing a dramatic swing into positive territory — up 1.3% so far — indicating that, while revenues are still down in real terms, the States may be seeing a turnaround. Occupancy was down 1% annually in Q2 but this quarter it’s up 4.3%, lending weight to this theory.

Across the pond, the UK and Europe are witnessing even more robust annual growth in RevPAR, with a 14.5% jump in the UK and 13% increase in Europe. Revenues appear to be growing well ahead of inflation with occupancy also showing sturdy growth.

Commenting on the findings, Melanie Brown, Executive Director of Data Insights at Key Data, observed that: “The US really has been the sick man of the short term rental industry during the first half of 2023. It is being hit from all sides after steep increases in supply over the past couple of years. This is going to take some time to unwind, with any deterioration in the economic landscape set to amplify the effects of this increased competition.”

Brown continued: “Meanwhile, Europe and the UK have managed to fend off a serious slowdown and are actually close to posting real terms annual revenue growth.”

Go to www.keydatadashboard.com for more.