What’s Happening On The Ground

If you’re wondering about where car rental rates are headed in the next year, well they’re headed up according to American Express Global Business Travel (GBT).

Amex GBT is predicting that strong demand and supply-side issues will push up car rental rates in North America and other regions of the world during the next year.

The TMC projects year-on-year car rental rate hikes of 5% in Canada and the US, 7% in Germany, 6.5% in the UK and 5% in France for the 12-month period ending in March 2024.

It made the predictions in its Ground Monitor 2023-24 report which also forecasts that prices in Argentina and Brazil are likely to go up by 6% and 5.5% respectively. Travellers in Australia also face increases of around 2%.

According to Amex GBT: “2023 looks like it will be a tale of two parts, pricewise. For most of this year, rental prices appear likely to continue to follow the rising trajectory set in 2022. As automotive production returns and rental fleets recover, price rises should stabilize from late 2023 into 2024.”

Even though supply chains for the car rental sector are set to improve, continuing growth from the leisure travel market will keep prices high.

The report states: “It is unlikely that prices will return to 2019 levels. Cars are evolving to become smarter; as they do so, they’re more expensive to buy, maintain, and insure.”

Are EVs the way?

All the major global rental brands are investing in EVs and low emission vehicles. Notable moves include Hertz’s $4.2 billion deal to purchase 100,000 Tesla EVs and Europcar’s pledge to make 20% of its fleet electric or hybrid by 2024.

The International Energy Agency forecasts almost one in five (18%) cars sold in 2023 will be EVs. Yet corporate travellers appear reluctant to rent them.

There are reports from Europe of supply now exceeding demand and of EVs sitting unused at rental locations.

What’s causing driver reluctance?

Cost may be an issue. EVs rent at a premium to conventional cars. Then, there can be hidden costs such as extra fees for charging. Range anxiety also remains a concern.

But the biggest factor may be a lack of driver familiarity with EVs. One sign of driver nervousness – drivers booking an EV and then requesting a conventional car when they arrive at the rental location.

Rail … A Sustainable Option …

When it comes to corporate travel in particular, rail offers an attractive package. T

here’s a strong convenience factor; stations tend to be in city centres, eliminating transfers and time spent at the airport. When there’s space to work and good connectivity onboard, the train can help travellers stay productive on the move.

But rail’s role in sustainability is what tends to drive corporate interest.

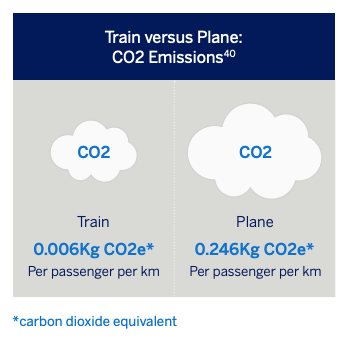

Rail has been shown to greatly reduce carbon emissions from corporate travel. Amex GBT and Egencia clients have achieved 90% reductions in emissions by making the shift from plane to train.

Persuaded by rail’s sustainability credentials, governments in Austria, Germany, Spain, and Scandinavia have been looking at legal measures to encourage travellers to move from the plane to the train. In May 2023, France went a step further by enacting legislation that bans domestic flights that can be replaced by a train journey of under two-and-a-half hours.

Gerardo Tejado, Senior Vice President Professional Services, Amex GBT, noted that: “Road and rail are also increasingly in the spotlight for companies wanting to make their programs more sustainable,”

However, the report points out that today only a handful of countries globally have adequate high-speed rail infrastructure in place.

In North America, the viable opportunities for using rail in corporate travel are largely limited to VIA Rail Canada services between Toronto and Montreal and the Acela Corridor in the northeastern US.

China and Japan have extensive networks that connect key business destinations. While Europe’s high-speed rail networks offer opportunities to shift travelers from air to rail.

For the full report, CLICK HERE.