Air Canada reports second quarter 2025 financial results

Air Canada reported its second quarter 2025 financial results today with the airline’s President and CEO, Michael Rousseau observing that: “Air Canada’s second quarter 2025 results showcase the airline’s many strengths in the face of a challenging environment.”

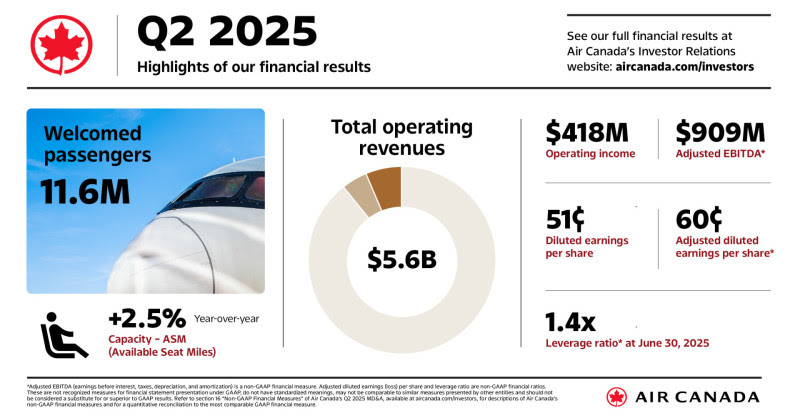

Rousseau continued: “We generated operating revenues exceeding $5.6 billion, up $113 million from the previous year. Operating income was $418 million, with an operating margin of 7.4%, and adjusted EBITDA was $909 million, with an adjusted EBITDA margin of 16.1%.”

And he said: “Operationally, we had an excellent spring, leading all major North American carriers in on-time performance for both May and June, which corresponded with strong gains in customer service scores. We remained disciplined and consistent in executing on a long-term plan that is rooted in Air Canada’s proven commercial strategy, while navigating macroeconomic uncertainty and geopolitical tensions.”

Said Rousseau: “We have strategically redirected capacity to high-demand markets and captured demand for premium services, leveraging the breadth and strength of our global network. Our results were further lifted by strong performances by Air Canada Cargo, Air Canada Vacations, and Aeroplan—each a key pillar of our diversified business.”

Highlights include:

- Operating revenues of $5.632 billion, an increase of 2% versus last year.

- Operating income of $418 million with operating margin of 7.4% and adjusted EBITDA* of $909 million with adjusted EBITDA margin* of 16.1%.

- Premium revenues up 5% from the second quarter of 2024.

- Cash flow from operating activities of $895 million and free cash flow* of $183 million.

- Completion of $500 million substantial issuer bid, with approximately 296 million total issued and outstanding shares at June 30 2025.

- Leverage ratio* of 1.4 at June 30, 2025.

Rousseau said that: “A key pillar of our strategy is delivering value to our shareholders through effective capital allocation programs. Building on the successful reinstatement in 2024 of our normal course share purchase program, we completed a $500 million substantial issuer bid during the quarter, purchasing 26.6 million shares for cancellation.”

And he added: “Since then, we have also fully repaid our convertible notes in cash upon maturity in July. As we look ahead, we are excited about our upcoming fleet additions and the opportunities they will unlock. Our confidence in our business outlook remains solid and we are reaffirming our financial guidance for the full year 2025.”

Tags: Air Canada, Michael Rousseau